Get paid globally. Settle to your wallet in minutes.

Accept cards, wallets, and local methods while payouts route automatically to your connected wallet. We never hold your funds.

- Non-custodial by design with direct wallet payouts

- 135+ currencies and local methods for global reach

- Typical payout time around 2 minutes

$1B+ processed in total volume. Works with the tools you already run.

This globe visualizes some of the payments our merchants receive in real time sponsored and provided by

Track approvals and payouts in real time

Follow every payment from authorization to wallet settlement, with instant status updates and alerts.

Live settlement feed

Immediate alerts for payments and payouts across regions.

Payout routing

Send settlements to the asset and wallet you choose.

Payouts landing in real time

How it works

Start fast, scale globally

Create your account

Set up your business profile in minutes.

Connect payout wallet

Link your wallet during onboarding so payouts route directly to you.

Accept payments

Go live online or in person with cards, wallets, and local methods.

Settle instantly

Revenue routes automatically to your wallet in about two minutes.

Ready to see the full flow?

Start with the launch bonus or talk to sales for custom routing.

Proof

Metrics teams trust

Global coverage, consistent uptime, and verified volume across industries.

Built for

Every business model, from solo to enterprise

Freelancers

Get paid globally without waiting on bank transfers.

Ecommerce

Lift approvals with local methods and faster checkout flows.

Platforms & SaaS

Route payouts to connected wallets with clear reporting.

Enterprise

Scale across markets with uptime, controls, and support.

Works with

Connect to the tools you already use

Compatible with leading ecommerce, invoicing, and funnel platforms.

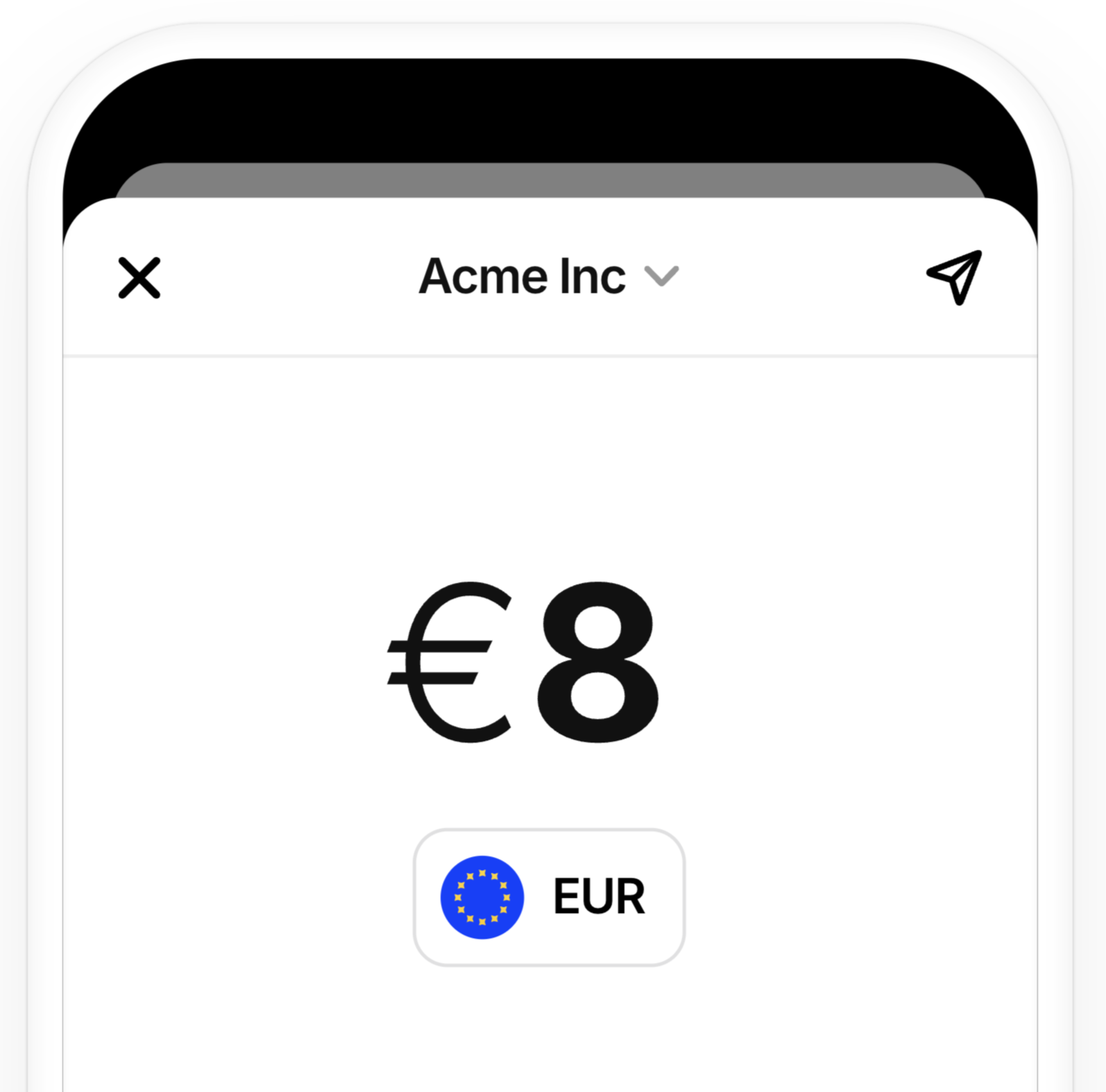

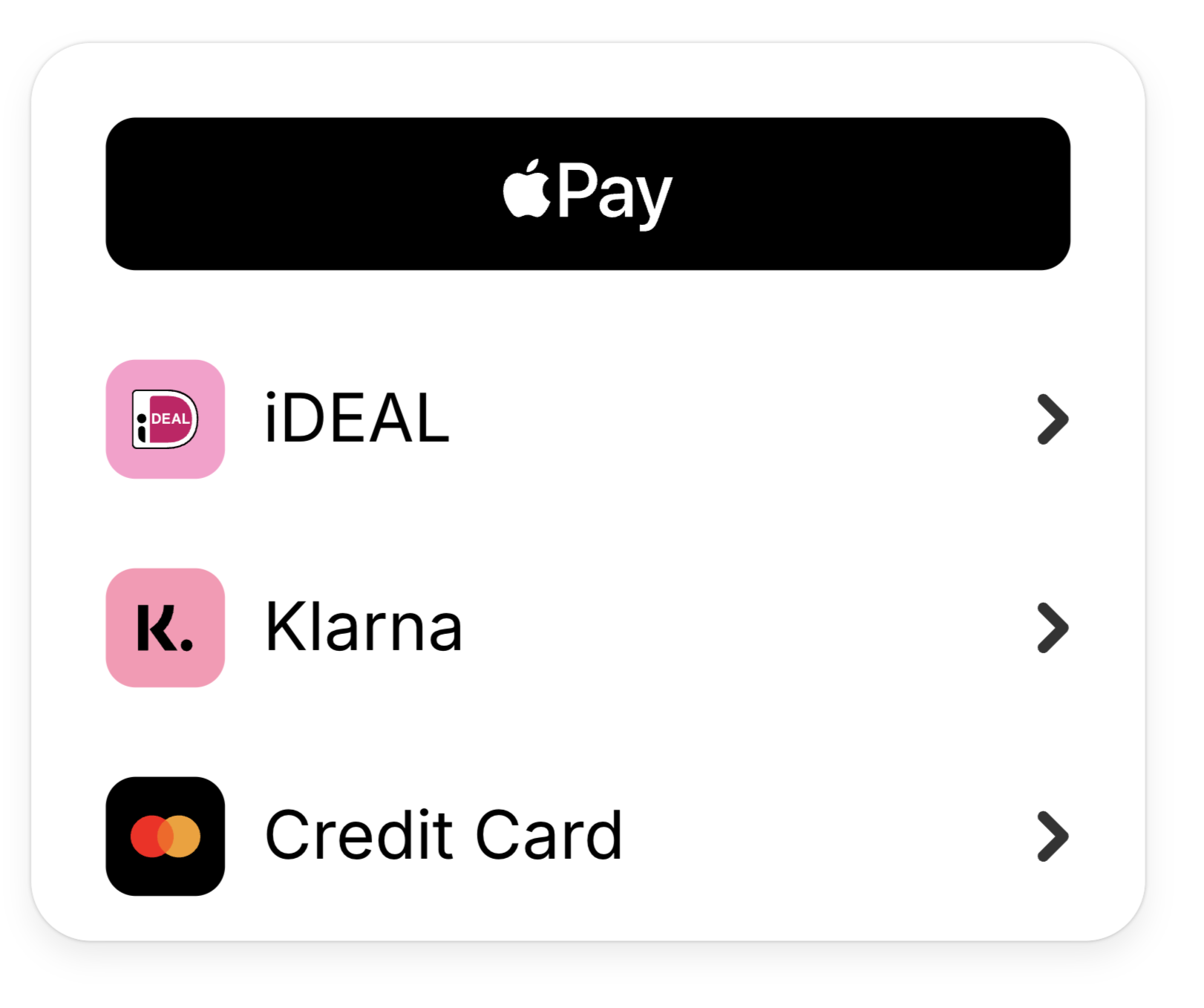

Payment methods

Offer every way your customers prefer to pay

Cards, wallets, and local methods that lift approval rates across regions, 35+ payment methods supported.

iDEAL

The most used online payment method in the Netherlands.

Mastercard

Accept payments from customers from anywhere in the world.

Maestro

Accept payments from customers from anywhere in the world.

Visa

Trusted cards with broad global coverage.

PayPal

The online wallet with 377 million active users worldwide.

Klarna

Combine all Klarna options into one seamless method.

American Express

Popular with premium and cross-border spenders.

Apple Pay

Let customers pay with their Apple device.

Google Pay

Saved cards across Google accounts worldwide.

Swish

A mobile banking payment method in Sweden.

Afterpay

Popular with shoppers in Australia and New Zealand.

Bancontact

The most popular payment method in Belgium.

Need a specific payment method?

We can enable regional options and help you optimize approvals.

Checkout experiences

Checkout flows built for conversion

Launch the right flow for every use case, from links to subscriptions.

Payment Links

Share hosted checkout links with consistent branding and receipts.

Optimized Checkout

Keep customers moving with saved payment options and retries.

Recurring Payments

Bill subscriptions on schedule with clear lifecycle events.

Tap to pay

Get paid in person, without missing a step.

PayPOS is a reliable terminal for in-person payments that stays in sync with your online flows.

Quiet intelligence

Smart systems working quietly in the background

AI helps route payments safely, reduce friction, and protect your business without slowing payouts. Your funds remain under your control at all times—AI never touches your money, it simply improves reliability.

Real-time transaction screening

Selective checks spot risk without blocking legitimate payments.

Fewer chargebacks, no unnecessary friction.

Payout integrity for connected wallets

Network signals help keep payout paths healthy and reliable.

Better wallets mean smoother payouts.

Higher approvals through smarter routing

Payments are optimized by region, method, and risk profile.

More approvals, fewer failed payments.

Merchant control

- We never custody merchant funds.

- AI never moves your money.

- Your wallet remains fully under your control.

Word from our CEO

Marios Petrou

Founder & CEO

From day one, our focus at WhiteRockPay has been simple: build payment infrastructure that businesses can truly rely on.

Payments are not just transactions — they are trust. When merchants choose how they get paid, they are choosing who they trust with the most critical part of their business.

We built WhiteRockPay with a long-term mindset: non-custodial by design, transparent in operation, and engineered to scale globally. Our responsibility is to make payments move reliably, safely, and without unnecessary friction — so our merchants can focus on growing with confidence.

We are proud of what we’ve built so far, and even more committed to what comes next.

Pricing

Transparent pricing you can plan around

Start free, then scale with predictable rates for every payment type.

Launch offer

Launch bonus

New accounts can process up to $3,000 at no cost while you test and go live.

Up to $3,000 in processing

Best for first-time launches and pilots.

Card Payments

PopularVisa, Mastercard, Apple Pay, and Google Pay.

Transaction fee per payment

- Coverage across regions and card types

- Payouts routed to your crypto wallet

- Retry controls with clear status tracking

Best for ecommerce and online services.

Buy Now Pay Later & PayPal

PayPal and major BNPL options supported.

Transaction fee per payment

- Alternative payment methods in one place

- Localized checkout experiences

- Consistent routing and reconciliation

Best for higher AOV and flexible checkout.

Launch with predictable pricing

Start free and unlock higher limits as your volume grows.

Wallet security

Your payout wallet stays yours

During onboarding you connect a payout wallet so funds can route directly to you. We only send payouts to that wallet and never have custody of your funds.

Why it matters

Non-custodial by design

- We cannot move funds or access private keys.

- Payouts are automatically routed to your chosen wallet.

- You keep full control of your crypto assets at all times.

Wallet connect happens during onboarding, not on this page.

Case studies

Teams that moved faster with Whiterockpay

Fictional examples that reflect real results and workflows.

Northbend Gear

18% fewer checkout drop-offs

Added local methods and saved payment details across regions.

Fieldnote Labs

Payouts in minutes instead of days

Shifted from bank delays to instant wallet settlement.

AtlasBridge SaaS

Unified reporting across 12 markets

Centralized approvals, retries, and payout routing.

FAQ

Questions, answered

Clear details on payouts, compliance, and security before you sign up.

What is Whiterockpay and how does it work?

Whiterockpay is a crypto payment gateway that enables businesses to accept payments in traditional currencies (like cards, PayPal, and more) and automatically receive payouts in cryptocurrency (such as USDT, Bitcoin, etc.). The platform allows businesses to process payments securely, instantly, and globally, with payouts made directly to the merchant’s crypto wallet within minutes, ensuring quick access to funds without delays.

Which payment methods can I accept through Whiterockpay?

- Credit and Debit Cards: Visa, Mastercard, Maestro, American Express

- Digital Wallets: PayPal, Apple Pay, Google Pay

- Local Payment Methods: iDEAL, Klarna, Bancontact, Swish, Afterpay

This ensures that you can cater to customers from all around the world, offering them their preferred payment method.

How does Whiterockpay's crypto payout system work?

Once a customer makes a payment through Whiterockpay, we process the transaction and convert the amount into cryptocurrency (e.g., USDT or Bitcoin). The funds are then instantly transferred to your connected crypto wallet, typically within two minutes of the successful transaction. This eliminates delays associated with traditional banking systems and ensures faster access to your funds.

Are there any transaction fees?

- Card payments, Apple Pay, Google Pay: 3.9% + $0.50 per transaction

- Buy Now Pay Later & PayPal: 5.9% + $0.50 per transaction

These fees cover the cost of payment processing, currency conversion, and crypto payouts.

Can I start accepting payments immediately after signing up?

Yes, Whiterockpay allows you to start accepting payments as soon as your account is activated. There's no KYC (Know Your Customer) process required for most users, so you can begin processing payments right away, with no delays or additional paperwork.

What currencies can I receive payouts in?

Whiterockpay supports payouts in multiple cryptocurrencies, including popular ones like USDT (Tether), Bitcoin, and Ethereum. You can choose to receive payouts in the cryptocurrency of your choice, based on your wallet configuration.

Is Whiterockpay secure? How do you protect my transactions?

Yes, Whiterockpay uses industry-leading encryption and blockchain technology to ensure the highest level of security for your transactions. Your payments are processed securely, and since we use blockchain for crypto payouts, the risk of fraud, chargebacks, or data theft is minimized. Whiterockpay also uses SSL certificates and other advanced security protocols to protect sensitive information.

Do I need any special technical knowledge to integrate Whiterockpay?

Not at all! Whiterockpay provides easy-to-use API documentation and integration tools that allow you to integrate the payment system into your website or e-commerce platform with minimal effort. Our team is also available to help with setup and any technical questions you may have. Whether you're a beginner or an experienced developer, the process is straightforward.

Will Whiterockpay work for international customers?

Absolutely! Whiterockpay supports over 135 currencies, enabling you to accept payments from customers around the world, regardless of their location. We also offer multiple payment methods popular in specific regions, such as iDEAL in the Netherlands or Swish in Sweden, so you can cater to local preferences while receiving instant crypto payouts.

How can I track my payments and payouts?

You can track all your transactions and payouts directly through the Whiterockpay dashboard. The dashboard provides real-time insights into your transaction history, including payment status, fees, and the total crypto payout received. Additionally, you'll receive email notifications whenever a payout is processed, so you’re always updated.

Is Whiterockpay regulated or licensed?

Whiterockpay operates in accordance with applicable laws and regulations in the jurisdictions we serve. While we don’t generally require full KYC from most users, we continuously monitor transactions for suspicious activity. If your business volume grows significantly, or if regulatory requirements in your region change, we may request additional information or verification to remain compliant.

How do you handle fraud prevention without KYC?

Even though we don’t ask most users for full KYC documentation, we employ robust anti-fraud tools and real-time monitoring systems. These systems automatically flag unusual patterns, helping protect both merchants and customers from fraudulent activity. Should higher-risk activity be detected, we have processes in place to request further identity verification if necessary.

Are credit card details stored securely?

Absolutely. We never store raw card data on our servers. Instead, Whiterockpay partners with PCI-DSS-compliant payment providers who use encryption and tokenization. This ensures sensitive card information stays secure and is processed following strict industry standards.

What about chargebacks and disputes?

Traditional card payments may still be subject to chargebacks, but when payouts are made in crypto, the funds you receive aren’t reversed by the blockchain itself. If a customer initiates a dispute through their bank or card issuer, we work with you and the issuing institution to handle it appropriately. Our dispute management system helps you stay informed throughout the process.

How are crypto payouts handled securely?

We leverage secure blockchain protocols and reputable wallet-connection partners. Once a payment is confirmed, funds are instantly converted to your chosen cryptocurrency and sent directly to your connected wallet. This means minimal counterparty risk and no prolonged holding periods. Whiterockpay does not retain custody of your crypto funds.

Does Whiterockpay hold my funds?

No. We operate on a non-custodial model. Payments are processed and settled directly to your connected wallet. Because we don’t store your funds, you always retain full control over your crypto assets, minimizing the risk of third-party custodial issues.

How do you protect data and transactions from hacks?

We use multiple layers of security, including SSL encryption, firewalls, and intrusion detection systems. Our infrastructure undergoes regular security assessments, and we employ industry best practices (such as 2FA and IP whitelisting) to safeguard both merchant and customer data.

What if Whiterockpay’s system goes offline?

Our platform is built with high-availability architecture, boasting a 99.95% uptime. In the unlikely event of downtime, any initiated transactions will be queued and processed as soon as our systems come back online. Since we don’t hold merchant funds, there’s no risk of your crypto being locked on our side.

Is Whiterockpay compliant with AML (Anti-Money Laundering) requirements?

Yes. We have an internal compliance program designed to detect and report suspicious transactions. While most users can onboard without lengthy KYC, we do monitor transactions in real time to ensure compliance with relevant AML regulations. If any unusual activity is detected, we may request additional verification or documentation as needed.

Will I ever be required to complete a KYC process?

For the majority of users and transaction volumes, no. However, if your activity triggers certain thresholds or specific regulatory requirements, we might ask for additional information to meet compliance obligations. We’ll always notify you promptly if such a case arises, and we strive to keep that process as seamless as possible.

Can I trust Whiterockpay with my business?

We’re committed to transparency, security, and regulatory compliance. Our technology stack is built on best-in-class security practices, and our quick, reliable crypto payouts set us apart in the industry. Whether you’re a small startup or an established global enterprise, you can rely on Whiterockpay to keep your transactions secure and your business growing.

Still comparing providers?

Get a walkthrough of pricing, payouts, and compliance.

%20(1).png)